What is a CVA Agreement? Insights right into Corporate Voluntary Agreements

Ultimate Guide to Comprehending Business Volunteer Agreements and How They Benefit Services

Company Voluntary Arrangements (CVAs) have come to be a tactical device for companies looking to browse monetary obstacles and restructure their operations. As the organization landscape continues to progress, understanding the ins and outs of CVAs and just how they can positively affect firms is important for educated decision-making.

Understanding Business Volunteer Agreements

In the realm of company administration, a fundamental idea that plays a crucial role fit the partnership between companies and stakeholders is the detailed mechanism of Business Volunteer Agreements. These contracts are voluntary commitments made by business to comply with certain requirements, techniques, or goals past what is legitimately required. By participating in Business Volunteer Agreements, companies show their dedication to social duty, sustainability, and honest organization methods.

Advantages of Business Voluntary Agreements

Relocating from an exploration of Corporate Volunteer Contracts' significance, we currently turn our attention to the substantial benefits these agreements supply to business and their stakeholders. One of the key benefits of Corporate Volunteer Contracts is the chance for firms to reorganize their debts in an extra manageable means. This can help relieve monetary burdens and stop potential bankruptcy, allowing business to continue running and potentially prosper. Additionally, these arrangements supply an organized framework for arrangements with creditors, cultivating open communication and partnership to get to mutually helpful solutions.

In Addition, Corporate Voluntary Arrangements can boost the company's track record and relationships with stakeholders by demonstrating a dedication to attending to economic obstacles responsibly. By proactively seeking services with voluntary contracts, services can display their devotion to fulfilling obligations and maintaining trust fund within the sector. Furthermore, these agreements can offer a degree of discretion, permitting firms to resolve economic problems without the general public examination that may accompany other restructuring options. Generally, Company Volunteer Contracts serve as a strategic device for business to navigate financial difficulties while protecting their operations and relationships.

Process of Executing CVAs

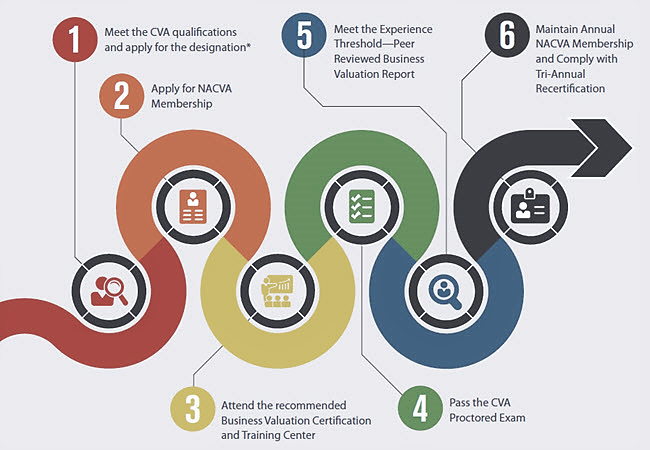

Recognizing the process of applying Corporate Volunteer Agreements is necessary for business looking for to browse financial difficulties efficiently and sustainably. The initial step in applying a CVA involves selecting an accredited insolvency professional that will work closely with the business to analyze its financial situation and feasibility. This preliminary analysis is essential in identifying whether a CVA is one of the most appropriate service for the firm's monetary troubles. As soon as the decision to proceed with a CVA is made, a proposition detailing how the company means to repay its financial institutions is composed. This proposition needs to be approved by the firm's creditors, that will certainly vote on its acceptance. If the proposition is accepted, the CVA is implemented, and the company needs to stick to the agreed-upon repayment plan. Throughout the application process, regular communication with creditors and persistent monetary management are key to the successful implementation of the CVA and the firm's eventual financial healing.

Secret Considerations for Companies

When assessing Company Voluntary Contracts, companies should carefully take into consideration vital variables to make sure successful economic restructuring. In addition, businesses ought to extensively assess their existing financial debt framework and evaluate the impact of the CVA on different stakeholders, consisting of financial institutions, distributors, and workers.

Another vital consideration is the degree of openness and communication throughout the CVA process. Open and truthful communication with all stakeholders is important for building count on and ensuring a smooth execution of the contract. Organizations need to also take into consideration seeking expert recommendations from legal professionals or financial consultants to browse the complexities of the CVA procedure effectively.

In addition, businesses need to assess the long-term ramifications of the CVA on their reputation and future funding possibilities. While a CVA can provide prompt alleviation, it is crucial to evaluate how it may affect relationships with financial institutions and investors over time. By very carefully taking into consideration these vital factors, businesses can make educated decisions relating to Business Voluntary Arrangements and establish themselves up for a successful monetary turnaround.

Success Stories of CVAs at work

Several companies have efficiently implemented Business Voluntary Contracts, showcasing the efficiency of this monetary restructuring device in rejuvenating their operations. One notable success tale is that of Company X, a having a hard time retail chain facing insolvency because of installing financial obligations and declining sales. By participating in a CVA, Business X had the ability to renegotiate lease contracts with property managers, decrease overhead costs, and restructure its financial debt responsibilities. Therefore, the business was able to maintain its economic placement, improve cash circulation, and stay clear of insolvency.

In one more instance, Business Y, a production firm burdened with tradition pension plan obligations, used a CVA to restructure its pension responsibilities and improve its operations. Through the CVA procedure, Firm Y accomplished considerable price savings, improved its competitiveness, and protected long-term sustainability.

These success stories highlight exactly how Business Volunteer Agreements can provide battling companies with a viable course towards monetary recuperation and operational turn-around - cva meaning business. By proactively addressing financial challenges and restructuring commitments, companies can arise more powerful, extra dexterous, and better placed for future development

Verdict

Finally, Corporate Volunteer Arrangements provide services an organized strategy to settling monetary troubles and reorganizing financial obligations. By applying CVAs, business can stay clear of bankruptcy, protect their properties, corporate voluntary agreement and maintain connections with lenders. The procedure of applying CVAs includes careful preparation, settlement, and dedication to conference agreed-upon terms. Businesses need to consider the prospective advantages and drawbacks of CVAs before determining to pursue this choice. In general, CVAs have actually verified to be reliable in aiding companies conquer economic obstacles and accomplish lasting sustainability.

In the realm of company administration, a basic idea that plays an essential role in shaping the partnership in between stakeholders and firms is the detailed device of Company Voluntary Contracts. By entering right into Company Volunteer Contracts, companies demonstrate their dedication to social responsibility, sustainability, and ethical company methods.

Moving from an expedition of Company Voluntary Agreements' significance, we currently turn our attention to the substantial benefits these agreements offer to business and their stakeholders.Moreover, Business Volunteer Arrangements can boost the company's credibility and relationships with stakeholders by demonstrating a commitment to attending to monetary difficulties properly.Recognizing the procedure of implementing Corporate Voluntary Arrangements is important for firms looking for to navigate economic obstacles effectively and sustainably.